Zillow's Homeownership Cost Report: What It Means and Why It Matters

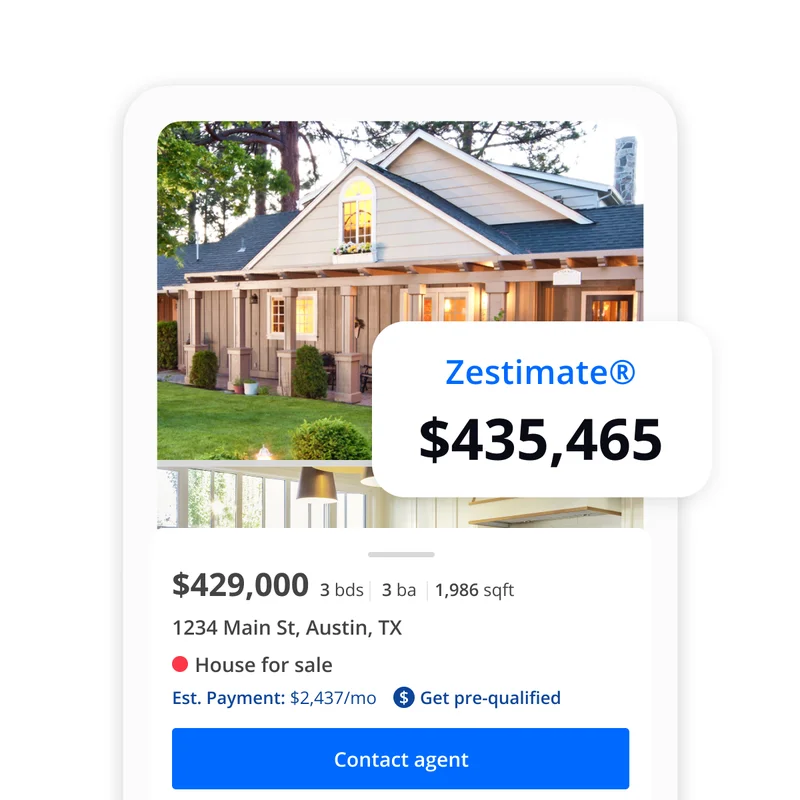

Okay, folks, let's dive into something that's been brewing in the back of my mind – and probably yours too, if you’re a homeowner or dreaming of becoming one. Zillow and Thumbtack just dropped a bombshell: U.S. homeownership now comes with nearly $16,000 in "hidden costs" every year. Sixteen grand! That's like, a whole extra mortgage payment just to maintain the dream. We're talking about $1,332 per month on average, encompassing maintenance, property taxes, and homeowner's insurance. According to Hidden homeownership costs hit nearly $16,000 a year, Zillow says, these costs are becoming a significant burden for homeowners.

Now, before you throw your hands up in despair, let's put this into perspective. Is this a wake-up call, or is it an opportunity to reimagine what homeownership truly means?

The Price of the Picket Fence

The breakdown is stark. Almost $11,000 for maintenance, $3,000 for property taxes, and another $2,000 for insurance. And it gets worse depending on where you live. New York City tops the charts at over $24,000 annually, followed by San Francisco and Boston. But here's the kicker: insurance costs are skyrocketing, especially in Florida. Miami, Jacksonville, Tampa, Orlando – all seeing insurance premiums jump by upwards of 70% since 2020! That's insane! It feels like we're living through a real-time experiment in risk assessment, and homeowners are footing the bill.

Zillow's Kara Ng points out that insurance costs are rising nearly twice as fast as homeowner incomes. Think about that for a second. The very thing that's supposed to protect your biggest investment is becoming an insurmountable barrier to even getting in the game. It’s like trying to climb a sand dune that keeps shifting beneath your feet.

I saw a comment on a Reddit thread the other day that really resonated with me. Someone wrote, "It's not just about affording the house anymore; it's about affording to keep the house." This is the reality we're facing. What does it mean when the promise of homeownership, the cornerstone of the American Dream, is becoming increasingly out of reach for so many?

Thumbtack's Morgan Olsen emphasizes preventative maintenance as a "safety net." And she's right! Small investments now can save you from massive headaches (and expenses) down the road. But are we truly equipped to handle this level of financial responsibility? Do we have the tools, the knowledge, and the resources to navigate this increasingly complex landscape?

The numbers tell a story, and it's not always a pretty one. $15,979 this year, up from $14,155 last year, and a whopping $9,080 back in 2017. Costs are outpacing income growth, home turnover is slowing, and an increasing number of metro areas are tilting towards becoming "buyers' markets." Are we witnessing a fundamental shift in the housing market, or is this just a temporary bump in the road?

A Chance to Reimagine

But here's where my optimism kicks in, because I’m not one to dwell on the negative for too long. What if this "crisis" is actually a catalyst for innovation? What if these rising costs force us to rethink how we build, maintain, and insure our homes?

Imagine a future where homes are designed with sustainability and resilience in mind, minimizing maintenance costs and maximizing energy efficiency. Picture smart homes that proactively monitor for potential problems, alerting us to issues before they become major expenses. Envision insurance models that reward preventative measures and incentivize responsible homeownership.

Maybe this is the push we need to embrace new technologies and strategies. Pre-fab homes with solar panels built in, community-owned insurance pools, AI-powered maintenance platforms... the possibilities are endless. It reminds me of the early days of the internet. People were skeptical, costs were high, but the potential was undeniable. And look at where we are now.

When I first saw these numbers, I honestly felt a pang of despair. But then I thought, no, this is an opportunity. This is a chance to build a more sustainable, equitable, and resilient housing market for everyone.

Of course, with every technological leap, there's a responsibility to consider the ethical implications. Will these innovations exacerbate existing inequalities? Will they create new barriers to entry for marginalized communities? We need to ensure that the future of homeownership is inclusive and accessible to all.

Time to Build a Better Dream

It's time to stop seeing homeownership as a static ideal and start viewing it as a dynamic, evolving concept. The dream isn't dead; it just needs a serious upgrade. Let's embrace the challenges, harness the power of innovation, and build a future where everyone has the opportunity to own a safe, affordable, and sustainable place to call home.

Tags: zillow homeownership costs report

Wonka: The Movie, The Cast, and The Chocolate – What Reddit is Saying

Next PostDaniel Driscoll and the Army Overhaul: What We Know

Related Articles